PROGRAMS

Two-thirds of Americans are financially illiterate which can lead to poor decisions around debt, savings and when to retire. Modern Capital Concepts is passionate about financial literacy and offers free programs held at Chicago Public Library branches - some can be attended remotely and some are child-friendly.

Join our email list to get invited to our free seminars open to the public.

FINANCIAL WELLNESS PROGRAMS STARTING AT $2,000

Contact us to schedule a financial wellness seminar and one-on-one mini-financial planning sessions for your employees. Examples of seminars presented at corporations and associations:

- Investing 101

- Women and Money

- Estate Planning and Asset Protection

- Essential Money Skills for Young Professionals

- Planning for Retirement

- Paying for College

How to Build a Website Like a Professional

You’ve read all your free member-only stories.Become a member to get unlimited access and support the voices you want to hear more from.

READING FOR SERIOUS INVESTORS

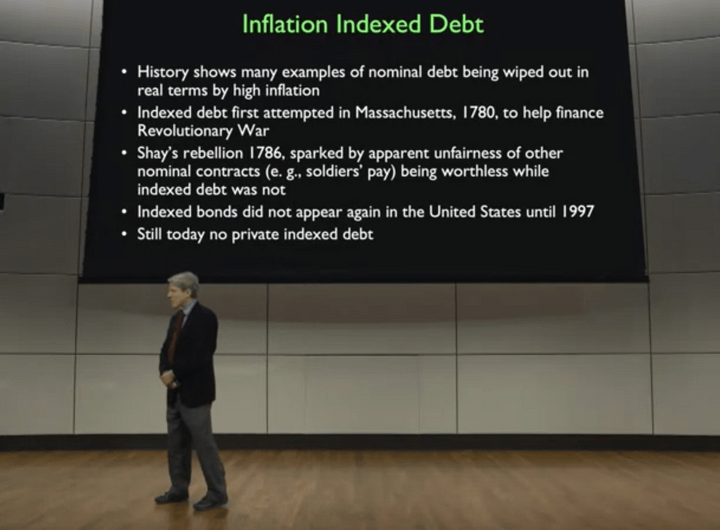

Financial Markets

The financial landscape is more than stocks.

Is now a good time to buy stocks? To answer this question, it is important to understand the relative attractiveness of stocks to other asset classes. Bonds, futures and options are some of the instruments used by investors. Take a look at this free MOOC to learn more. Financial Markets taught by Robert Shiller at Yale.

Racial Wealth Gap

Why is there a racial wealth gap?

The gap between rich and poor is widening in the US with the most egregious effects experienced by Black people. What are some of the causes and what history should non-Blacks be aware of so solutions can be put forth that are sensitive to past injustices. Download the audible book or purchase online or at your local bookstore.

Investments Text Book

The seminal text on investing.

Bodie Kane Marcus was the textbook I used in Investing 101 at the University of Chicago Booth School of Business. Borrow a recent edition or buy online.

Investopedia

Online investing dictionary

Reliable source for looking up investment terms and concepts.

Bloomberg TV

Online investing dictionary

Bloomberg markets is the premier source for market news. First 30 minutes are free for non-subscribers. Monthly subscriptions are comparable to other news sources.

THE ART OF THE ELEVATOR PITCH

April 16, 2019 at Lake Forest College, Chicago, IL

How does an art history major get into finance? I had to convince employers to look at my potential not just what was on my degree.

UPCOMING EVENTS OPEN TO THE PUBLIC

PAST EVENTS

PLANNING FOR RETIREMENT

Friday, April 28, 2023

NOON – 1:00 PM CST

When people embark on adulthood there are rites of passage and milestones that guide young people: buying a house, starting a family, graduate school, getting a promotion to the corner office, etc. Planning for retirement can be more challenging because there is no set script. It is up to each person to design a life that is meaningful and financially sustainable.

Planning for retirement involves complex decisions around saving and paying off debt while balancing lifestyle, supporting adult children, taking care of aging parents, working in retirement, managing taxes and health care costs, estate planning and charitable giving, Social Security and Medicare, among others.

INVESTING 101

Wednesday, February 15

12 PM – 1 PM CST

When is a good time to invest? When is it better to pay off debt than invest? How do I get started investing? What is socially responsible ESG investing? Does the 60/40 portfolio still work?

Learn the basics of investing in stocks, setting financial goals, risk, and diversification. CERTIFIED FINANCIAL PLANNER™ Khloé U. Karova will answer your questions.

View video here.

ESSENTIAL MONEY SKILLS FOR YOUNG PROFESSIONALS

Friday, January 27

12 PM – 1 PM CST

This seminar answers FAQs from professionals in their 20s and 30s. Topics include saving for emergencies, managing student loan debt, and planning for long-term goals of retirement and more.

Access the recording here.

PAYING FOR COLLEGE

Tuesday, January 24

Hosted by Melissa Stanley: Realtor with 20+ years of experience. Helping buyers, sellers, and renters. Residential and Commercial Real Estate.When applying for financial aid don’t be surprised when the amount the college thinks you can pay is considerably higher than the amount you can afford. The Federal aid formulas have consistently overestimated what middle-class families can afford. Have a plan to manage the gap!

We will cover myths versus realities in paying for college and explore funding scenarios through case studies:

1. High Earner / High Savings

2. High Earner / Low Savings

3. Paying From Rental Income / Dividends

4. Divorced Parents

5. Leaving A Legacy: Making Savings Last Longer

6. Grad School

RADICAL BUDGETING

Thursday, January 5

12 PM – 1 PM CST

Budgeting is foundational to financial planning at every phase. Like yoga, it requires practice. When financial resources are strained due to inflation, gentrification, or life changes, allocating resources intentionally and sustainably is key.

Radical Budgeting will discuss the following:

• How to make a budget

• What to do when your spending habits are not in sync with your partner's?

• What are signs that your habits sabotage your financial goals?

• What is a sustainable level of spending?

WOMEN AND MONEY

Thursday, October 28, 2021

NOON – 1:00 PM CST

Live via Zoom

Learn the basics of investing and how to become a better consumer of financial services.

Financial planning topics include

- Financial planning at each life stage: 20s, 30s, 40s, 50s and beyond.

- Budgeting and saving for emergencies

- Managing student loans and debt

- College savings and paying for college

- Overcoming financial obstacles

- Planning for retirement and more

Join Zoom Meeting

https://us02web.zoom.us/j/83863662661?pwd=a1pHOEZ2aEhyQnNRUGt0aWNXRVVkZz09

Meeting ID: 838 6366 2661

Passcode: 147056

Feel free to forward the webinar link to a friend. Email khloe@moderncapitalconcepts.com if you are planning on attending.

SUSTAINABLE ESG INVESTING

Friday, March 12, 2021

12:00 PM – 1:00 PM CST

Live via Zoom

Learn about socially responsible investing (SRI) and the differences between socially responsible and environmental social governance (ESG) themes. This seminar is designed to help participants understand how SRI or ESG investments further social goals by rewarding “good” companies or advocating certain causes. CERTIFIED FINANCIAL PLANNER™ Khloé U. Karova will answer your questions.

Financial planning offered through Modern Capital Concepts, Inc. a Registered Investment Advisor in the states of Illinois and Texas and separate entity from LPL Financial.

Khloé U. Karova holds the Series 7 with LPL Financial and 66 license with LPL and Modern Capital Concepts. The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of the following states: AK, AZ, CA, CO, DE, FL, IL, IN, KY, MA, MD, MI, MN, MO, NE, NJ, NV, NY, OR, PA, SD, TX, VA, WA, WI.

Securities and advisory services are offered through LPL Financial, a Registered Investment Advisor, member FINRA /SIPC.

Copyright 2013 LPL Compliance Tracking 1-578732